This article can be found on the EnergyLogic website here

Continuing the Discussion

As introduced in last week’s blog, we’re further exploring income inequality and its effects on housing attainability. Read on below to hear more about what we and others think can be done to reach this important objective. Change may be more achievable during this period of disruption.

Don’t Defer the Dream

In 1990 as President of the Denver Home Builders Association and the Colorado President for what is now Lennar, I negotiated a groundbreaking agreement with the Federal Housing Administration to ensure that new homes were marketed without prejudice to all regardless of race or national origin. This agreement gained unanimous approval of the HBA’s Board of Directors because it was the right thing to do. We saw evidence of fair marketing practices become mainstream in advertising and direct contact with potential homebuyers.

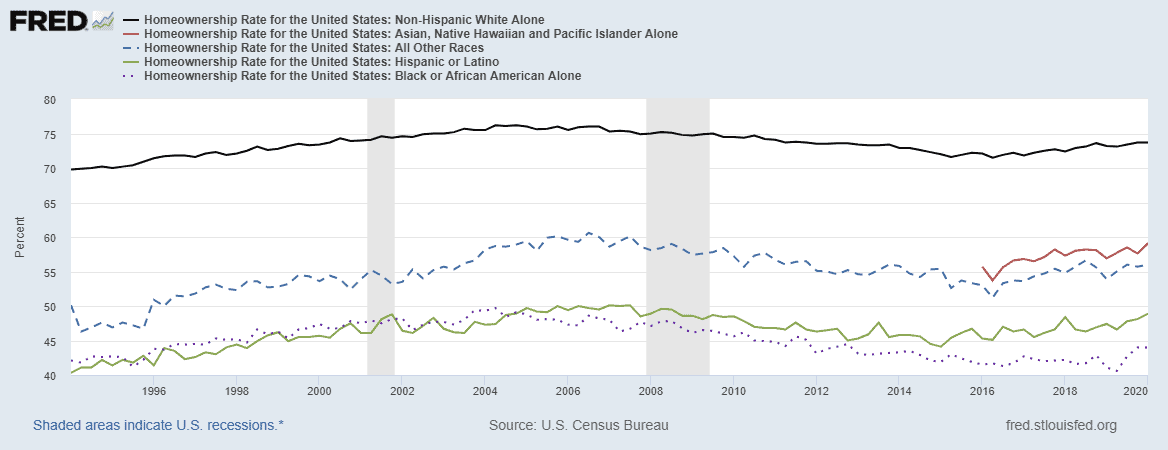

It seemed to me that we were making a lot of progress, as evidenced by the increasing rate of African American homeownership. According to the U.S. Census Bureau, the rate of African American homeownership rose steadily, increasing from 42% in the 1990’s to 49.7% in 2004. Over the next fifteen years, African American homeownership declined, falling to 40.6% in April 2019.

Homeownership is the primary method of wealth accumulation in the U.S. While the Great Recession had major impacts on all homeowners, there was an outsized decline in African American homeownership. Some roadblocks have been torn down. I was proud to negotiate a significant agreement that supported those aspirations. Ostensibly, government-sponsored redlining is a thing of the past, but its scars persist, with Black Americans’ family wealth remaining only a fraction of other groups. Our industry can and must do more. Dreams need to be realized, not deferred.

-- Jeff Whiton, former President of HBA of Metro Denver

Making Space for Other Important Voices

In speaking with other business owners and leaders in our industry (all white, all male), I can relate that we are all struggling to find the right words to use to address the state of inequality and discrimination in our nation. In particular, most of us don’t want to simply issue hollow proclamations of support.

This report’s lead author Alanna McCargo and her co-authors provide us with excellent food for thought. We’d also like to thank Montell Watson via Housing Wire for his recent piece. He also makes excellent points and his work brought McCargo’s work to our attention. While we are figuring out how we can best be part of the solution we’re taking this opportunity to do some serious listening.

-- Steve Byers, CEO of EnergyLogic

This article can be found on the EnergyLogic website here