One of the most mentioned items in the Inflation Reduction Act (IRA) is heat pumps. The IRA provides significant rebates and/or tax credits for the installation of heat pumps. These rebates and tax credits make this technology worth considering for all builders and homeowners installing new equipment or upgrading old systems. Let’s cover what types of heat pumps are available and why you will want to consider them.

Heat pumps are up to five times more efficient than standard systems and have the ability to use air or water to heat and cool systems within a home. Heat pumps use electricity to transfer thermal energy from one place to another instead of producing heat through combustion.

Heat pumps can be classified into two types: ground-source and air-source. Both can provide efficient heating and cooling solutions with minimal electricity consumption and no combustion.

How Different Types of Heat Pumps Function:

Ground Source Heat Pumps:

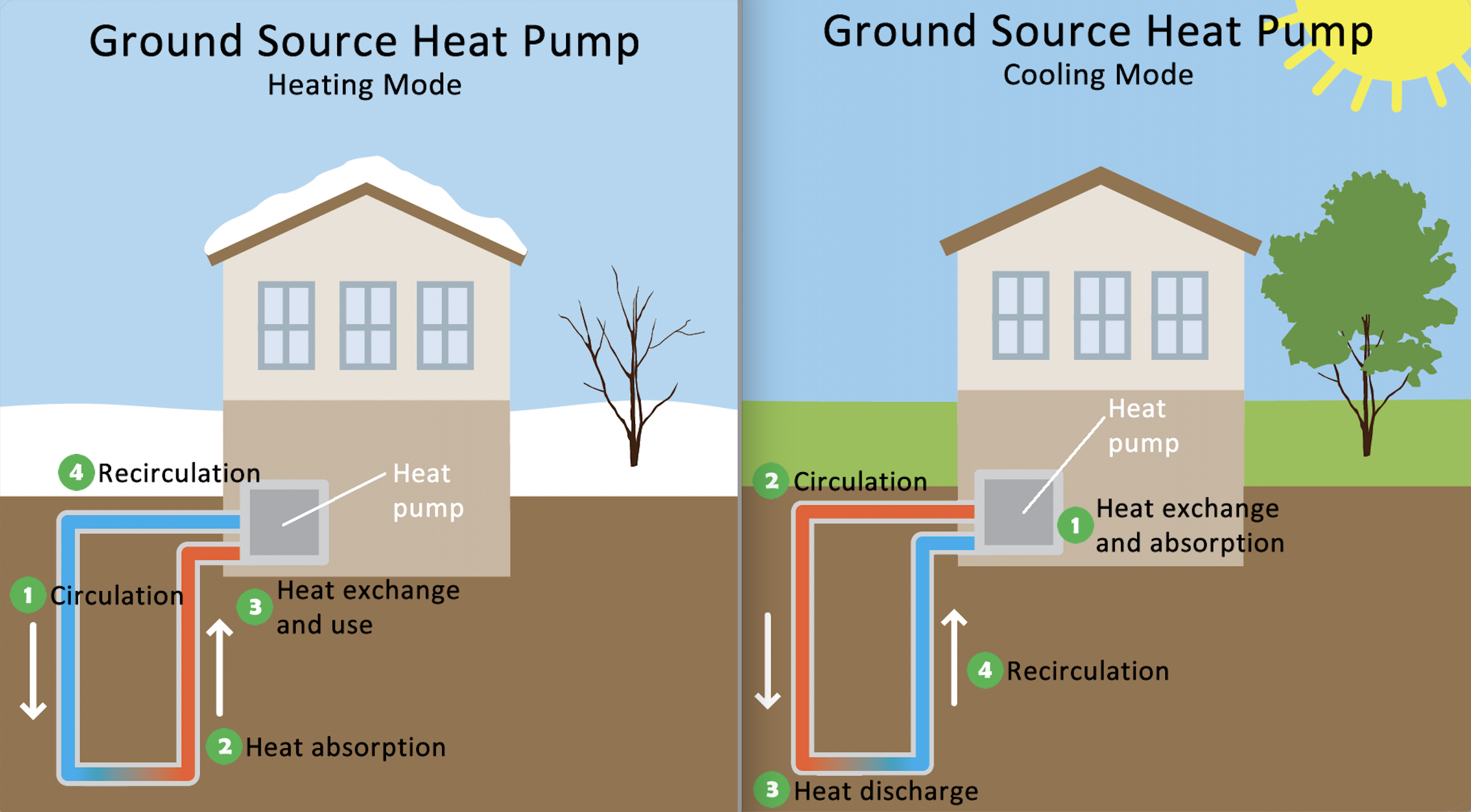

Geothermal heat pumps rely on the earth’s constant temperature below ground level to efficiently transfer heating and cooling through underground pipes. This type of system uses an exchange loop connected between two points inside and outside the house. During colder months, refrigerants will absorb warm temperatures found in the soil and pump it indoors while expelling cooler indoor temperatures back underground. This system can also work in reverse, moving heat from indoors into the ground, effectively cooling the building. This type of system offers substantial energy savings year-round and consistent operation even in extremely low temperatures.

Source: https://www.epa.gov/rhc/geothermal-heating-and-cooling-technologies#:~:text=A%20ground%20source%20heat%20pump,)%2C%20and%20even%20water%20heating.

- Advantages

- Efficiency: Runs efficiently in cold climates due to the ground being a consistent 48-52 degrees Fahrenheit.

- Durability: Ground source heat pump systems last 20+ years and the heat pump itself lasts 25-50 years for the underground infrastructure.

- GWP Usage: Uses fewer and lower global warming potential (GWP) refrigerants.

- The ground loop can be:

- Water-to-water for domestic hot water and radiant heat systems.

- Water-to-air for an air handler system to cool or heat.

- Disadvantages

- Considerable expense in installing ground source heat pump systems, but the IRA offers a 40% rebate for the installation of U.S.-made products.

Air Source Heat Pumps:

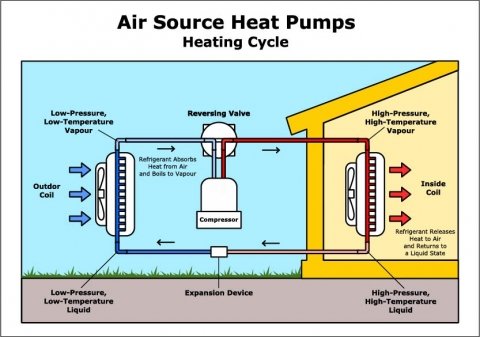

Air-source units draw their external thermal sources from outdoor air using evaporator coils like those employed by conventional air conditioning and refrigeration systems. These require lower pressures for operation since fans help move ambient temperatures toward either side depending on the demand for cooling or heating. This technology can be up to five times more efficient than traditional systems and can now operate to temperatures around –15 F, with some systems even surpassing –15 F.

Source: https://www.energy.gov/energysaver/air-source-heat-pumps

- Advantages

- Expense: Air source heat pumps have a significantly lower installation expense.

- Air source heat pump can be:

- GWP Usage: Uses fewer and lower global warming potential (GWP) refrigerants. CO2 units are available.

- Durability: Air source heat pumps last up to 20 years.

- Disadvantages

- Most air source heat pumps run with decreasing efficiency past -15 degrees Fahrenheit, however, some air source heat pumps can maintain high efficiency past -25 degrees Fahrenheit.

- As with most distribution systems, air source heat pumps can have issues with low airflow and incorrect refrigerant charge.

Additional types of Air Source Heat Pumps:

Heat Pump Water Heater:

Heat pump water heaters (HPWH) are an energy-efficient alternative to traditional storage water heaters. By using the ambient air temperature, HPWHs work by transferring existing thermal energy from the air to water instead of generating heat directly. Heat pumps use a compressor system connected with refrigerant pipes that transfer warm air from the surrounding environment into its cold chamber, where it is heated before being pumped out as hot water. This process allows for more efficient heating since no additional energy has been used aside from the electricity required for running the compressor and fan systems needed for operation, making it 4X more efficient than the standard model. The efficiency of this energy source makes it cost-effective over time when compared to other methods of heating via traditional burning sources or electric tankless models - meaning lower monthly bills and no combustion in the building. Overall, HPWH technology represents a reliable and sustainable way of generating hot water both at home and commercially.

Heat Pump Dryer:

Heat pump dryers are an innovative type of clothes dryer that works in a different way than traditional models. Heat pump dryers utilize refrigerant to transfer heat energy from the surrounding air into the drum. The refrigerant is heated by a compressor and then circulated throughout the drying cycle; this creates hot air, which gently dries items within the machine's tumbler. During operation, moisture-laden air passes through an evaporator where it condenses and is then pumped out of the unit, thereby extracting water from clothing items during use. This process involves transferring latent heat from outdoor or indoor air and converting it to heat inside the appliance for effective drying performance which can reduce energy use by 28% compared to standard dryers. Heat pump dryers also have the advantage of not needing to be vented to an outside space. This can result in significant savings in a new installation.

Heat Pump Federal Tax Credit 2023

Under the IRA, homeowners are eligible for a 30% federal tax credit for the upfront costs of air-source and ground-source heat pumps with a maximum credit of $2,000 a year.

Listed below are further individualized tax credits Under the High-Efficiency Electric Home Rebate Act (HEEHRA) program that supports low to moderate-income households. HEEHRA will cover 100% of the costs for low-income households (under 80% AMI) and 50% for moderate-income households (between 80%-150% AMI) up to $14,000.

| Type of Heat Pump |

HEEHRA will cover costs up to: |

Extra Information |

| Heat Pump Clothes Dryer |

|

How it works: Heat pump clothes dryers transfer hot air from outside the dryer to inside. This hot air flows through the dryer drum, sucking moisture out of your clothes. Rather than releasing the humid air through a dryer vent to the exterior of your home like a conventional dryer, a heat pump dryer sends it through an evaporator to remove the moisture and then reuses the warm air to continue drying your clothes. |

| Heat Pump Water Heater |

|

How it works: Heat pump water heaters work like a refrigerator but in reverse. They leverage electricity to move heat from place to place rather than generating heat directly. They are 4X more efficient than the standard model, produce no emissions, and can operate at low ambient temperatures. |

| Heat Pump HVAC |

|

How it works: Heat pump HVAC is a type of central system that pumps hot air from inside a home to the outside to cool down the interior. This heat pump can also pump hot air into a home by reversing the flow. |

- Additionally, $4000 for an electric panel upgrade and $2500 for electric wiring upgrades are available

Builders will want to understand which homeowners qualify for the additional HEEHRA benefits. This may apply to building low-income and retirement communities in particular.

Builders IRA Tax Credits under ENERGY STAR & ZERH

The section 45L Tax Credit for Energy Efficient New Homes has been updated and extended through 2032 under the IRA. The base-level tax credit will be tied to ENERGY STAR certification for single-family, manufactured, and multifamily homes. $2,500 is available for Single-Family homes and manufactured homes certified under ENERGY STAR.

Homes certified to DOE’s Zero Energy Ready (ZERH) Program can receive a larger tax credit of $5000.

Both credits may be subject to a prevailing wage requirement.

Additionally, builders and homeowners should check out local rebates available that can potentially be stacked with HEEHRA and the IRA in the link below.

Click here to learn about more incentives in your state for renewables and efficiency.

Heat Pumps Across the United States

Heat pumps are gaining momentum around the world as they reduce electricity use by up to 500% compared to conventional forms of heating and cooling. With the introduction of the IRA, the heat pump market in the United States is expected to continue to grow tremendously. According to the Census Bureau, 970,000 single-family homes were built in 2021. 369,000 homes had a heat pump installed and of these, 361,000 were air-source and 8,000 were ground-source. Today, more than 17 million homes in the U.S. have adopted central heat pumps, with 4 million heat pumps being sold in 2022. The US residential heat pump market will continue to grow as homeowners and builders are offered incentives through the IRA.